How Business Owners Are Using IRS Code 7702 to Keep More Profit and Build Private Wealth

Most CPAs don’t know about this — but it’s been used by the wealthy for decades. Now it’s your turn to learn how.

Watch This Free Strategy Breakdown for Business Owners

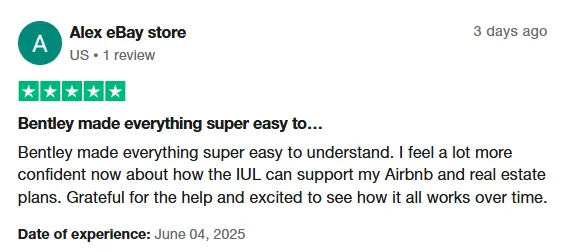

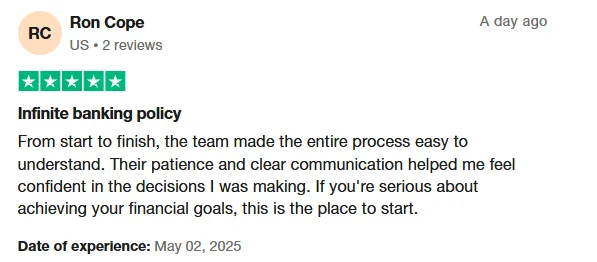

In this quick video, Bentley breaks down how business owners use IRS Code 7702 to turn tax dollars into personal wealth. No restructuring. No CPA swap. Just a smarter way to grow.

These Strategies Will Help You to...

Redirect Taxes Into Wealth-

Turn what would’ve gone to the IRS into a private wealth-building plan — fully legal under IRS Code 7702.

Grow Capital Without Market Risk or Tax Drag-

Build a compounding asset off the books — without worrying about annual tax hits or volatility.Lock In Top Talent with Golden Handcuffs-

Use these plans to reward and retain key employees — while growing value on your side too.Access Liquidity on Your Terms-

Tap into your strategy’s cash value for business expansion, reinvestment, or tax-free retirement distributions — no penalties, no tax triggers.Lower Your Taxable Exposure Long-Term- Use executive bonus funding to reduce your overall tax obligations and keep more profits inside your ecosystem.

This is For You If...

You’re making good money — but know you’re still leaving money on the table.

You’re looking for advanced strategies that go beyond deductions and “safe” advice.

You want to reward and retain key team members — without giving up equity or inflating payroll.

You want your business income to build personal, generational wealth — not just cover expenses.

You’re ready to move like the wealthy do — with intentional, IRS-backed strategy.

This strategy is only offered to a limited number of qualified businesses per month. Don’t wait.

FAQ

❓Is this a tax loophole?

No. It’s based on IRS Code 7702 — used by large corporations and wealthy individuals for decades.

❓Do I need to fire my CPA?

Absolutely not. This strategy works alongside what your accountant is already doing.

West Palm Beach, Florida

(561) 785-5101

© 2025 The Ultimate Growth Group. The Ultimate Growth Group operates as part of the Vantage Financial Alliance network, specializing in tailored financial strategies to help individuals, families, and businesses achieve their goals. License #G124705.

For verification, you can visit the official Florida Department of Financial Services site at https://licenseesearch.fldfs.com/.

Licensed in FL, CT, MO, TX, OH, SC, IN, CA. While licenses vary by state, our services are not limited to specific locations, as we work with a nationwide team of experienced professionals to meet your needs wherever you are.